Thought Leadership

Understanding the Inflation Reduction Act: Key Attributes and Opportunities for Climate-Focused Businesses

Breaking down the details on the biggest climate bill in U.S. history

By Maxwell McCool, Analyst, September 2022

On August 16, President Biden signed the Inflation Reduction Act (“IRA”) into law, the most sweeping climate and energy bill ever enacted in the United States. At $369 billion, the bill dedicates the majority of its focus to decarbonizing the U.S., in the hopes of transforming our clean energy landscape through opportunities and incentives for clean technology adoption.

But how does the 700-plus page federal bill impact business as a whole? For Third Economy clients, the bill’s changes will have a meaningful impact on mid-to-large-sized corporations, from climate credits and rebates to corporate tax changes. Read on for the details.

Climate Opportunities

Clean Energy – Renewal of Climate Tax Credits and Rebates

The Details

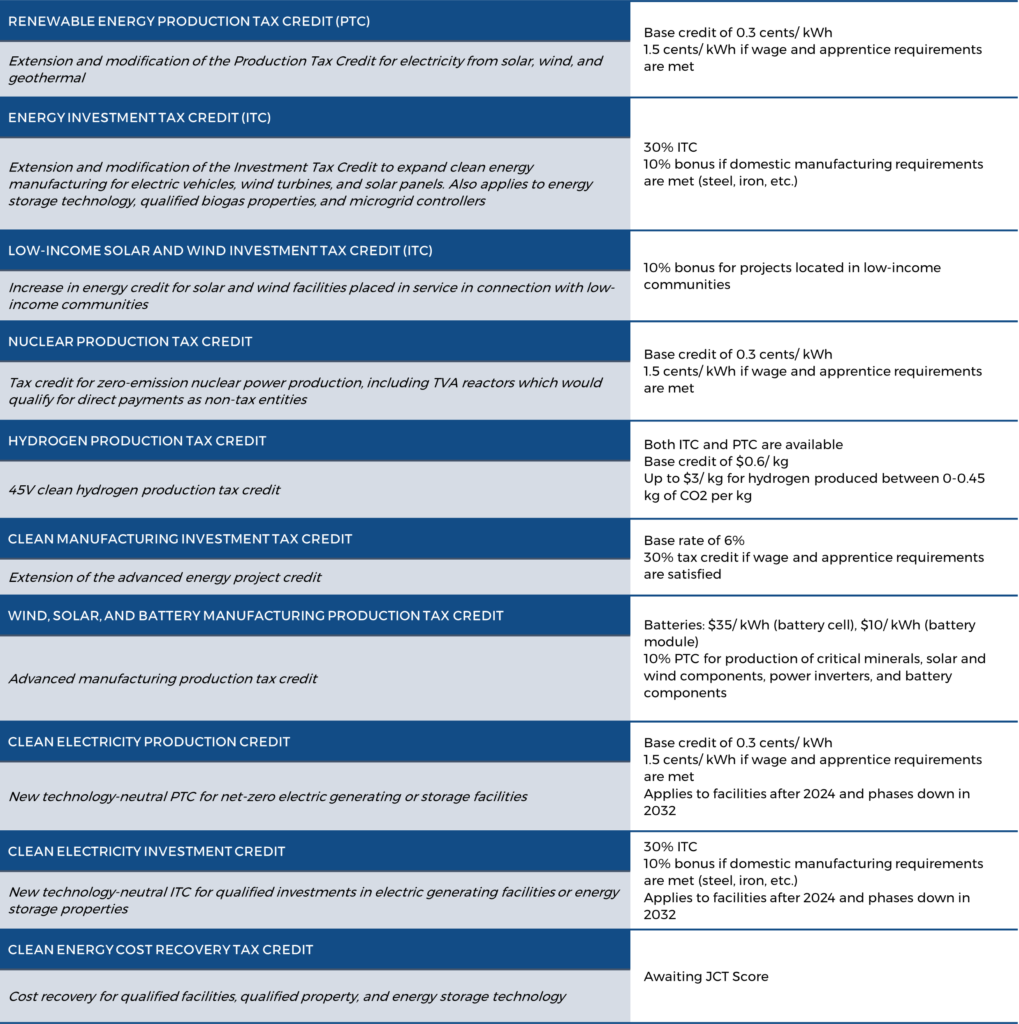

The IRA bill renews (and restores to full value) two key tax credit provisions for companies creating carbon-free electricity: Production Tax Credits (“PTC”) and Investment Tax Credits (“ITC”). While these credits previously applied primarily to companies generating solar and wind power, the IRA expands these credits into more nascent technologies like hydropower, nuclear and geothermal energy generation (1). The renewal of these existing credits is both a continued investment in established carbon-free electricity generation, and an incentive for energy market innovation. These tax credits will ultimately apply to all carbon-free electricity generation technologies starting in 2025 (2).

Why It Matters

For clients that are looking to comply with coming regulation on GHG emissions and effectively manage their financials, these tax credits offer an enticing opportunity on both ends. Corporations can now benefit from investing in these technologies within their supply chains and facility management, especially if the energy produced is domestic, meets wage and apprenticeship requirements, and/or in low-income communities.

*Table figures supplied by Climate Tech VC

Carbon Capture - Increased Tax Credits

The Details

In an effort to make carbon capture and storage (“CCS”) more lucrative for companies and easier to access, the IRA bill significantly lowers the threshold of qualified carbon oxide (“QCO”) that projects must capture annually to qualify for Section 45Q tax credits (3). To make CCS more attractive to corporations, the IRA bill has increased the tax credit value per ton (see table below), as well as created the option to transfer these tax credits to an unrelated taxpayer (2), in exchange for cash (outside of taxable income). The eligible start date for CCS projects is now extended to December 31, 2032 (2).

(2)

Why It Matters

The bill not only increases capital investment in CCS, but the bill’s direct payment option (through a tax refund) unlocks liquidity options for project developers as well. This enables corporates to better forecast and model CCS project returns and enable investment in this burgeoning technology.

Corporate Tax Changes

Corporate Alternative Minimum Tax

The Details

For U.S.-based corporations with at least $1 billion in revenue over a three-year average and foreign-headquartered groups with at least $100 million in U.S. revenue, the IRA established a 15% alternative minimum tax (“AMT”) on book income (4). The new Corporate AMT applies only if the regular corporate tax is less than 15%. This update is aimed at truing up the roughly 125 corporations that are currently paying effective tax rates of 1.1 percent.

There are some key details worth noting in this language, including the gray area around the future guidance for corporations that have a change in ownership or experience a decline in earnings (thus affecting book income). Time will tell how the IRS enforces these details.

Why It Matters

The bill will immediately affect 125 U.S.-based corporations, raising $222 billion for climate investments (5). While many clients and prospects will look to the tax professionals to guide them through the details of this changing regulation, we’ll be monitoring how this inflow of capital will be collected by the IRS and ultimately, managed by our public systems, through this historic transition to clean energy.

Excise Tax on Stock Buybacks

The Details

The IRA bill imposes a non-deductible 1% excise tax on the fair market value of stock repurchased by publicly traded corporations or their specified affiliates (4). The new rules cover repurchases by both U.S. public corporations and U.S. affiliates of foreign public corporations.

For the bill’s authors, the tax is aimed at encouraging large cap companies to reinvest cash on their balance sheet in their workers (to boost jobs and pay), instead of consolidating ownership, preserving stock prices, and/or reducing the cost of capital. It’s important to note that this tax rate would not apply to distributions or repurchases that are treated as dividends, and/or as a part of a few special circumstances:

- Repurchases from a tax-free reorganization

- Repurchases that contributed to an employee retirement or stock ownership plan

- Repurchases that are less than $1 million annually

- Repurchases in the ordinary course of business by a dealer in securities

- Repurchases by regulated investment companies or real estate investment trusts

Why It Matters

This provision is one of the most controversial in the bill, particularly for our corporate clients. The major question moving forward is: how will companies use their cash on hand to create value for their shareholders?

From a governance perspective, stock buybacks can be problematic if they lead to the inflation of senior executives’ compensation, but a tax could also create an unnecessary hoarding of cash on the balance sheet, leading to underused stockholder capital. As Jesse Fried of Harvard Law School recently said in an opinion piece for The Wall Street Journal, “Because CEO pay is tied closely to a firm’s size, this bloating will drive up executive compensation, further hurting investors (6).”

Ultimately, the buyback tax is only 1%, a nominal tax that is not likely to have major ripples in our economy, for corporations or for investors. While this tax is said to be just a starting point for Congressional Democrats, it remains to be seen if an incremental tax approach is on the horizon.

The IRA bill is changing the way that we approach climate innovation today, for both consumers and corporations alike. We are optimistic about the bill’s push for a rapid adoption of clean energy through private sector incentives that reward companies for investing in domestic manufacturing and innovation.

Wonder how to take advantage of coming regulation and legislative change? 3E has advised companies across industries on proactive climate strategies and shareholder engagement. Reach out to our team today to talk about your company's unique needs.

Cited Sources:

- Inflation Reduction Act Energy Tax Proposal Summary (natlawreview.com)

- Inflation Reduction Act Includes Clean Energy Tax Credits (natlawreview.com)

- Here’s what’s in the Inflation Reduction Act, the sweeping health and climate bill passed Sunday | The Hill

- Inflation Reduction Act Creates Opportunities for Investors (natlawreview.com)

- Summary: Closing Tax Loopholes in the Inflation Reduction Act of 2022 (Senate Democrats' Summary)

- The Virtues of Stock Buybacks (The Wall Street Journal)