Thought Leadership

SEC Releases New Climate Change Disclosure Rule

Key Takeaways from the SEC’s Proposed Enhancement and Standardization of Climate-Related Disclosures

By Third Economy Staff, October 2022

In March 2022, the U.S. Securities and Exchange Commission (SEC) announced a proposal to advance and standardize disclosures related to climate change.

If adopted, the proposal would require publicly-traded companies to disclose certain climate-related risks in their registration statements and periodic reports, including governance and strategy around climate-related risk, impact from climate events, greenhouse gas (GHG) emissions, and progress towards public climate-related goals or targets for companies that have made prior commitments.

The proposed requirements would incorporate Task Force on Climate-Related Financial Disclosures (TCFD) and Greenhouse Gas Protocol reporting into 10-K filings, requiring listed companies to publish Scope 1 and 2 climate emissions, phased over the next few years.

Our View

While there is much synthesis yet to come on today’s announcement, the steps taken by the SEC broadly signal that the focus is (appropriately) on the governance of climate risk, the potential business risks that climate-change poses, and the resulting activities to adapt the business model if these risks prove to be material. We are heartened by the inclusion of existing frameworks, like the TCFD, and the carveout for materiality on Scope 3 emissions.

What are the Specifics?

As drafted, the proposal would require companies (“registrants”) to disclose information about:

- Governance: Oversight of climate-related risks and relevant risk management processes by the company’s board and management.

- Material Impacts: The potential for climate-related risks to have a material impact on a company’s business and consolidated financial statements over a short-, medium- and long-term time horizon.

- Risk Identification & Management Systems: The opportunity for climate-related risks to affect a company’s “strategy, business model, and outlook” and its process for “identifying, assessing, and managing climate-related risks and integrating these into the registrant’s overall risk management system or processes”

- Transition Planning, Scenario Analysis and Carbon Pricing: Any relevant information on transition-planning, scenario analysis or carbon pricing that is used to assess business strategy and manage climate-related risks.

- Climate-Related Events: Overall impact of climate-related events (“severe weather events and other natural conditions”) within a company’s financial statements, including estimates and assumptions.

Additionally, companies would be required to disclose the following information, according to TCFD and GHG Protocol standards:

- Scope 1 Emissions: Direct Greenhouse Gas (GHG) Emissions.

- Scope 2 Emissions: Indirect emissions from purchased electricity or other forms of energy (“separately disclosed, expressed both by disaggregated constituent greenhouse gases and in the aggregate, and in absolute terms, not including offsets, and in terms of intensity (per unit of economic value or production”).

- Scope 3 Emissions (Exemption for Smaller Reporting Companies): Indirect emissions from upstream and downstream activities in a company’s value chain, if material, and/or if the registrant has set a GHG emissions target or goal that includes Scope 3 emissions.

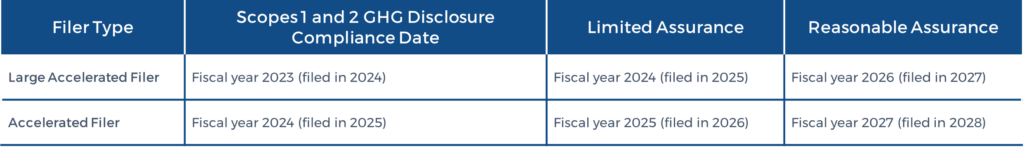

“Accelerated” and “large accelerated” filers (see below for definition) would also be required to engage with an independent attestation provider to provide assurance on Scope 1 and Scope 2 emissions.

Finally, companies who have set public targets or goals around climate will also be required to:

- Submit Plans and Progress: Companies will be required to submit relevant data to indicate if progress is being made against public goals, with updates each fiscal year. This includes relevant information about carbon offsets and renewable energy certificates.

Who Will Be Affected?

- Publicly traded companies of all sizes

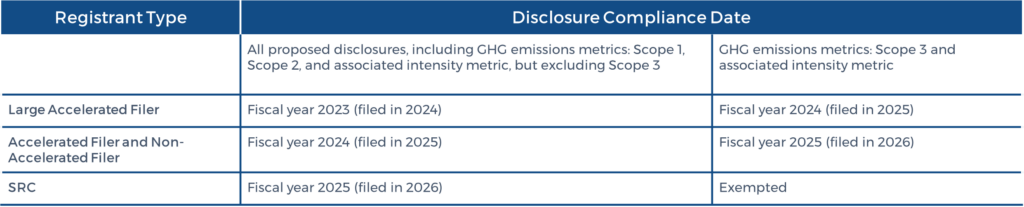

- The SEC makes a distinction between “Large Accelerated” and “Accelerated” Filers, in addition to Smaller Reporting Companies SRCs, creating three separate “phase-in” timelines for companies of different sizes.

When Would This Go Into Effect?

- The SEC has proposed a “phase-in” period for all companies, depending upon the filer status and Scope 3 reporting requirements:

Next Steps – UPDATED MARCH 2024

Comments letters were collected over a three-month period, from March 21 to June 22, 2022, during which the SEC received more than 10,000 responses. The majority of the comment letters sympathize with the proposal, while several members of Congress and other prominent figures have expressed their opposition.

The Commission issued its final ruling in March 2024.

Additional Resources:

- SEC Fact Sheet: https://www.sec.gov/files/33-11042-fact-sheet.pdf.

- SEC Rule Proposal: https://www.sec.gov/rules/proposed/2022/33-11042.pdf.