Thought Leadership

SEC Approves Long-Awaited Climate-Related Disclosure Rule

Key Takeaways from the SEC's Final Climate Risk Reporting Ruling

By Pamela Gramlich, Senior Associate, Head of Climate and Environmental Solutions, and Clare Bassi, Sustainability Research Lead, April 2024

UPDATE (April 2024)

In April 2024, the SEC issued a stay its climate-related disclosures rules, pending a judicial review from the Eighth Circuit. As stated in the press release, “the [SEC] will continue vigorously defending the Final Rules’ validity in court and looks forward to expeditious resolution of the litigation.”

Whether or not the SEC’s rules are implemented in short order, our advice remains – Scope 1, 2, and 3 emissions data provides useful information for companies, investors and stakeholders, and encourage our clients – regardless of size, or registration status – to consider the full impacts of their operations and value chains. Disclosures are just the beginning of key insights that ultimately, drive value.

Overview

On March 6, 2024, the US Securities and Exchange Commission (“SEC”) voted 3-2 to mandate public companies to disclose climate-related risks in their financial reporting, creating a federal baseline for climate reporting.

The new ruling requires publicly traded companies to disclose certain climate-related risks in their registration statements and periodic reports, including strategy around climate-related risk, impact from severe climate events, and Scope 1 and Scope 2 greenhouse gas (GHG) emissions (for larger filers only). Most notably absent from this ruling was the original proposal’s requirement for Scope 3 emissions reporting from companies of any size, as well as the need for climate expertise on companies’ board of directors.

While some of the details may have changed in this final ruling, the original spirit of the proposal remains: to inform investors of the actual or potential material impact of climate-related risks to a company’s business strategy, operations and financial outlook.

For more information on the ruling, check out the full details of the SEC’s press release and fact sheet here: https://www.sec.gov/news/press-release/2024-31.

What are the Specifics?

The new rule requires public companies (“registrants”) to disclose select information in their financial reporting about how climate-related risks have a material impact on their business strategy, results of operations, and/or financial condition, including:

Large Accelerated and Accelerated Filers Only*

- SCOPE 1 EMISSIONS: Direct Greenhouse Gas (GHG) emissions.

- SCOPE 2 EMISSIONS: Indirect emissions from purchased electricity or other forms of energy.

- ASSURANCE: Limited assurance on Scope 1 and Scope 2 emissions within 3 years of initial GHG reporting and reasonable assurance within 7 years of GHG reporting.

All Filers (see registrant categories below)

- GOVERNANCE: Board and management oversight of climate-related risks and related risk management processes.

- MATERIAL IMPACTS: An assessment of how climate-related risks, both actual and potential, affect a company’s “strategy, business model, and outlook”; additionally, if the registrant has taken steps to mitigate these risks as part of its strategy, it should provide a clear description (both qualitative and quantitative) of the costs incurred and the financial impacts resulting from these actions.

- CLIMATE-RELATED EVENTS: Capitalized costs, expenditures expenses and losses incurred from climate-related events, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise.

- RISK IDENTIFICATION & MANAGEMENT SYSTEMS: The opportunity for climate-related risks to affect a company’s “strategy, business model, and outlook” and its process for “identifying, assessing, and managing climate-related risks” and how any such process is being integrated into the registrant’s overall risk management system. In addition, specified disclosures are now required related to activities to mitigate or adapt to a material climate-related risk, including transition plans, scenario analysis, or internal carbon prices.

- TARGET AND GOALS: Companies who have set public, climate-related targets or goals will also be required to disclose material expenditures and material impacts on financial estimates and assumptions as a direct result of the target or goal or actions taken to make progress toward meeting such target or goal. If the company uses renewable energy credits or certificates (RECs) or carbon offsets as a material component to achieve its target, the company must also disclose the capitalized costs, expenditures expensed, and losses related to the RECs and offsets.

Who Will Be Affected?

- Publicly-traded companies of all sizes – see compliance timelines below.

- The SEC makes a distinction between “Large Accelerated” and “Accelerated” Filers, in addition to “Non-Accelerated Filers”, “Smaller Reporting Companies” (SRCs) and “Emerging Growth Companies” (EGCs).

- Large accelerated filer issuers have a public float of $700mm or more

- Accelerated filer issuers have a public float of between $75mm and $700 mm

- Small reporting companies (SRCs) have a public float of less than $250 million or less than $100 million in annual revenues

- Non accelerated filer issuers are companies that qualify as smaller reporting companies (SRCs) with annual revenues of less than $100 million and public float of less than $700 million

- Emerging growth companies (EGCs) have total annual gross revenues of less than $1.235 billion and have not sold common equity securities

When Would This Go Into Effect?

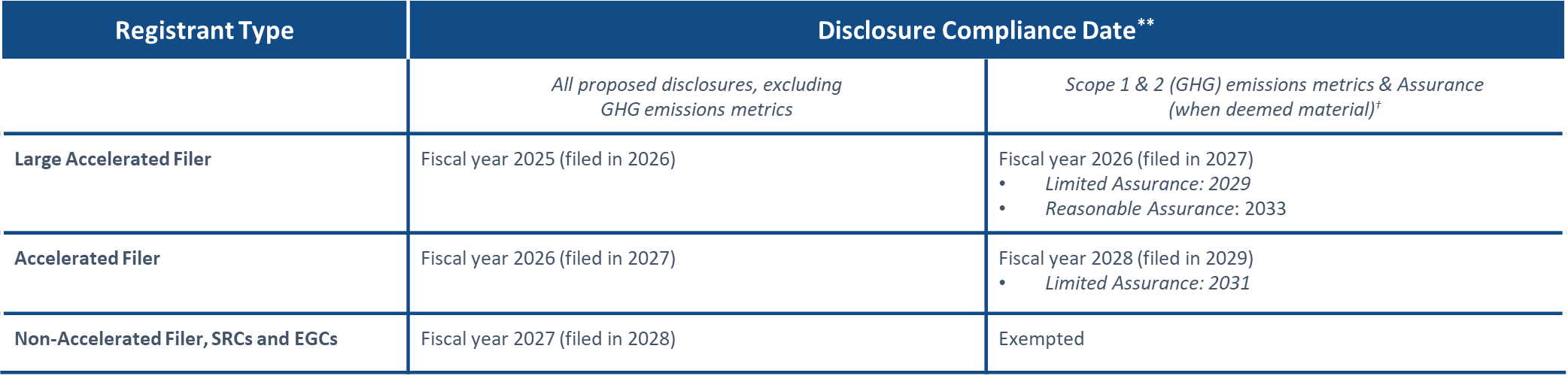

- The SEC has proposed a “phase-in” period for all companies, depending upon the filer status. This includes general disclosure dates, GHG emissions reporting and limited and reasonable and limited assurance.

Key Compliance Dates

Our View

This historic ruling will equip shareholders with standardized climate disclosures that are essential to making informed investment decisions as the climate continues to change, and as we strive to meet the goals of the Paris Agreement.

The SEC reviewed over 24,000 comments from companies, investors and other stakeholders on the initial proposal, doing their best to balance clear investor demands for comparable climate-risk data and corporate feedback on the potential costs and challenges of compliance. We believe that the SEC ended up in a balanced position that speaks to both sides of the capital markets, while also creating a starting framework for addressing the critical issue of climate change. While the final rule was weaker than the proposed regulation, we feel that it is a step in the right direction to work toward our mission of creating a more sustainable economy.

We feel that Scope 1, 2, and 3 emissions provide decision-useful information for companies, investors and stakeholders, and encourage our clients – regardless of regulatory requirements, size, or registration status – to consider the full climate impacts of their operations and value chains as a responsible business practice.

Third Economy is Here to Help

Third Economy was created to help businesses build their governance and sustainability capabilities to take advantage of financial trends and market demands. Want to know how this ruling would affect your business? Reach out to our team of experts to discuss what the SEC’s ruling means for your company and unique positioning.

* Registrant definitions are listed in the page below and on the SEC website.

** Disclosures will be presented in registration statements and Exchange Act annual reports filed with the Commission.

† Material is defined as impacting business strategy, operations or financial performance.

Disclaimer: The information provided does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available are for general informational purposes only.